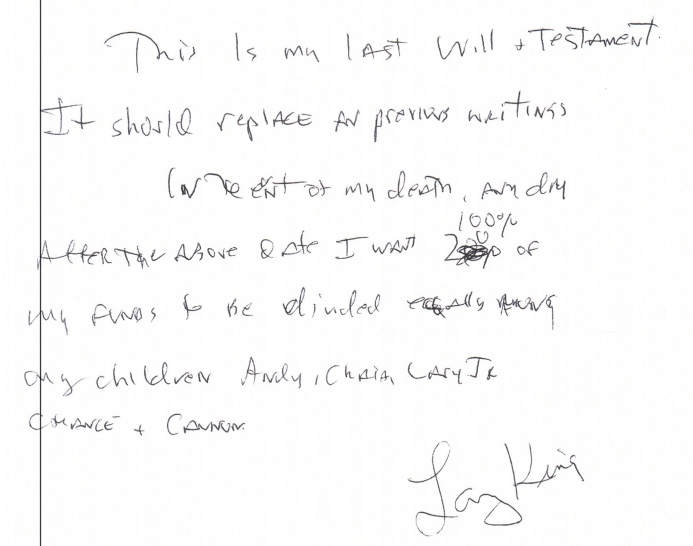

A short time before his death, Larry King attempted to…

Stimulus money not subject to claims of your creditors

Ohio’s Attorney General has made it clear: creditors cannot attach or seize your stimulus money. Ohio law protects certain assets from creditors’ claims. These are called “exemptions.” For example, you can have a certain amount of equity in your car and in your house that your creditors cannot take from you. And you can keep those assets if you file bankruptcy. We can now add to that list the money you receive from the CARES Act. To be sure it is protected, you may want to put the money into a separate bank account so that it is not co-mingled with money from any other sources. This will make it clear exactly what the source of the money is and that this protection extends to it. It is also important to remember that, if you are facing an account garnishment in a collection case, the money can be temporarily seized, but should be returned upon your attorney filing an objection and showing documentation proving that the money was from the stimulus program.