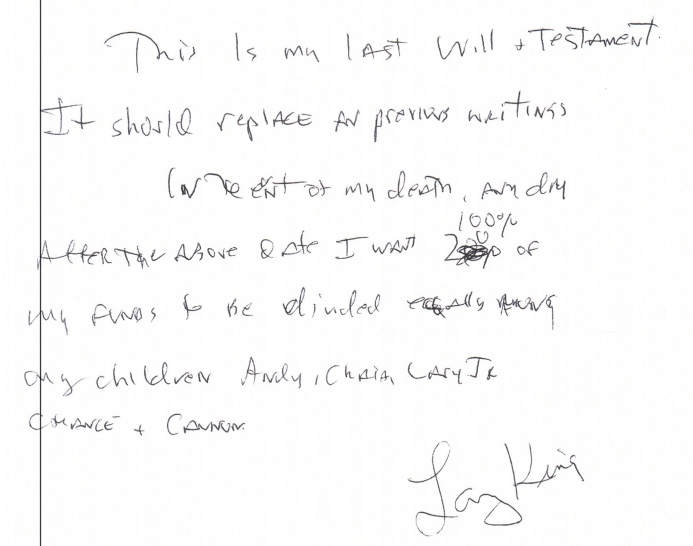

A short time before his death, Larry King attempted to…

Understanding the COVID-19 Federal Lending Option Basics

There are two federal programs available to help businesses and non-profits in response to the COVID-19 epidemic. They serve very different purposes and have very different provisions for repayment or forgiveness.

Paycheck Protection Program (PPP)

PPP loans are designed to help businesses and non-profits keep their employees and owners paid at normal wages and salaries. The borrower completes an application and provides required documentation with an SBA-approved bank. The loan is for 2.5x the company’s average monthly payroll costs (which is a phrase that includes a lot of parts of employee compensation) and is designed to accrue interest at a rate of 1%. The loans are expected to be approved and funds distributed in a matter of hours to a couple of days. The loan can then be used for payroll, rent (for pre-existent leases), mortgage interest (for pre-existent mortgages), and utilities. If the funds are used for those things and maintain full-time employees and compensation levels, then the funds spent in the first 8 weeks after the loan is granted will be forgiven.

Economic Injury Disaster Loans (EIDL)

EIDL loans are low-interest loans (3.75% interest) for small businesses and non-profits. They can have terms as long as 30 years and payments do not start until one year after the loan is granted. While EIDL loans are not normally forgiven, borrowers may be eligible for a one-time grant of up to $10,000.00 to be applied against their loan.

PPP loans are the primary focus of most companies today. They are a fast and powerful way to help meet your payroll, rent, and utility overheads for the next two months. It is important that interested businesses act fast. Experts estimate that the funds will be exhausted within a few days. Interested businesses should complete their application and contact their local SBA-approved bank immediately. You should also be ready to offer other documentation that is normally required by a bank (articles of incorporation, operating agreement, borrowing resolutions, etc.). If your business is one of our clients, we likely have these documents ready and available for you. If not, we are ready to assist you with finding or creating these instruments, if needed.

There are many other details for these programs. You are welcome to comb through the 880 pages of the CARES Act (like we did!), or contact us. Whatever you do, please act quickly. The PPP loans will not be available for long.