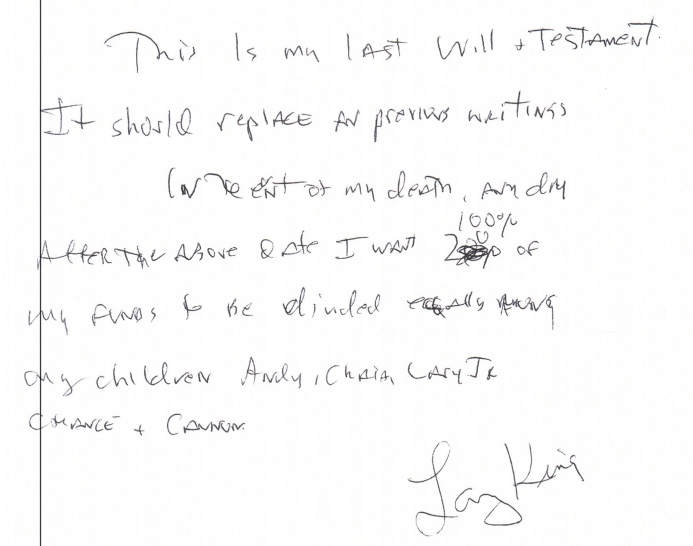

A short time before his death, Larry King attempted to…

Things to remember when your 1099s arrive

It is the time of year you may be receiving 1099s. Here are a couple of things to keep in mind that we are seeing this year:

UNEMPLOYMENT BENEFIT IDENTITY THEFT

If you receive a 1099 for unemployment benefits, but you did not apply for them in 2020, someone may have stolen your identity to get benefits. Here is a link to the Ohio Unemployment office telling you what to do if you find yourself in this situation: https://unemploymenthelp.ohio.gov/IdentityTheft/?fbclid=IwAR0U_Z_L-mS1gvDmtkLN_BdWDkRgtYmi_Hz2PfcK2baPas45RX0w7AFxyQE

DEBTS FORGIVEN IN BANKRUPTCY

If you had debts forgiven in a bankruptcy in 2020 and you receive a 1099 for one of those debts, you do NOT have to pay taxes on that debt. There is a simple form that is filed with your tax return that says that debt was included in your bankruptcy (box a – “debt was included in a title 11 case”). Here is a link to the form: https://www.irs.gov/pub/irs-pdf/f982.pdf